Trouble Ahead for 4 Pillars in Ontario? Class Action in British Columbia causing sleepless nights in Franchises across Canada!

Trouble Ahead for 4 Pillars in Ontario? Class Action in British Columbia causing sleepless nights in Franchises across Canada!

After my departure from 4 Pillars Consulting Group, in February of 2010, I have often wondered how this organization continues to avoid Provincial and Federal Legislation that was clearly written with the 4 Pillars debt consulting services model in mind. From providing individual debt settlements on behalf of debtors with collection agencies and their creditors to negotiating with Trustees on behalf of a debtor in determining the terms of a Consumer Proposal, at no time did the organization feel that they ought to have any oversight in what they did. Myself, I had a number of debates with Robert Glen, the 4 Pillars manager in Windsor, Ontario with issues on our true value to a debtor when first, the authorizations that we would send had no determinant weight, as collection agencies and creditors could simply ignore them, without recourse. Second, we would tell the debtor that we were “representing” them and their interests in the Consumer Proposal, Bankruptcy or Debt Settlement process, yet we were not licensed to provide advice by any calculation within the confines of any regulatory statute, or the Law Society Act.

Moving ahead, I recall a time in December of 2014, while speaking with my wife and owner of New Beginnings Debt Consulting at the time, that there were new changes in the Collection Agency Act of Ontario that was going to have a significant impact on how we conduct business and interact with the public. I even reached out to Reginald Rocha, 4 Pillars Director and Partner, to discuss the changes in the Act, as we shared a common model in negotiations with the various players in the Debt Settlement Industry. You see, the Ontario government had recently enacted the new Collection Agency Act to its current name the Collection and Debt Settlement Services Act. As with any changes in legislation I consulted with our Lawyers and they agreed that these new changes affected how we would interact with the public, but more importantly that registration with the Ministry of Government and Consumer Services would be a requirement and would come into effect as of June 1st, 2015. I had asked if there was a way that I could become exempt and was informed that if I became a licensed trustee or a lawyer, I would be provided with exemption status and could continue to negotiate settlements with Trustees, collection agencies and creditors without the registration requirement.

After thoughtful consideration, I chose to become a Licensed Paralegal with the Law Society of Ontario and although it did not provide me with immediate exemption status, it did provide me with standing when dealing with a debtor’s Trustee, Creditors and Collection Agencies. As discussed before, I had great issue and concern that while with 4 Pillars, we were passing along these authorizations and telling debtors that this authorization gave us authority to speak to their creditors on their behalf while we were negotiating a client’s debt with a Trustee or negotiating an individual settlement. Now that I became licensed as a Paralegal I had standing and my authorizations carried weight. Section 22(2) of Regulation 74 of the Collection and Debt Settlement Services Act essentially says that at no time may a creditor, collection agency or agent in the collection of a debt contact a debtor upon being notified that the debtor has hired a legal practitioner in the negotiation of a debt. Now I could provide legal advice to my clients. At that time, in order to become compliant with the law, my practice registered with the Ministry and until just recently, in August of 2018, Paralegals have now gained exemption status and are now free from that burden.

I did, however, find it troubling that 4 Pillars never registered with the Ministry. I don’t believe any of them are lawyers. I do recall a conversation with Robert Glen, the 4 Pillars manager in Windsor, Ontario about a year ago that he wanted to go back to school and get a Law Degree. Being a lifelong, family friend, I told him he would make a great lawye, although he indicated that his corporate offices in British Columbia told him that he would have to give up his franchise. I know many have become Credit Counselors in attempt to give them some sort of status or credibility in the industry. Recently, however, the Office of the Superintendent of Bankruptcy (OSB) has threatened to revoke many of their credit counseling registrations as the OSB had discovered that trustees were handing off debtors back to the 4 Pillars agent and paying 4 Pillars the $75 counseling fee for each session. The OSB then made changes to how Trustee’s conduct themselves and under the new Directive No. 1R4 (https://www.ic.gc.ca/eic/site/bsf-osb.nsf/eng/br03864.html), a Trustee cannot send a debtor to a credit counselor who was referred to the Trustee originally do have unless the Trustee places the credit counselor under the Trustee’s license. I will note that although Credit Counselors are registered with the OSB, they do not provide oversight of Credit Counselors, are not licensed and thusly have no legal standing or authority under past or current law to address a debtor’s needs.

Recently, I came across an article by Mr. Mark Silverthorn. Mr. Silverthorn equates himself as having a great deal of knowledge in the Debt Industry, and although we have quarreled from time to time, I do have a great deal of respect for him and the expertise he carries in our industry. Mr. Silverthorn wrote an article, entitled; “Debt Relief Industry Commentator Mark Silverthorn Predicts Potential Fallout from Four Pillars’ Defamation Lawsuit Against Victoria Trustee Colleen Craig”. I will say that I had come across Ms. Collen Craig’s blog a few years ago regarding her position with how 4 Pillars conducts themselves in Victoria. From my own personal experience with working at 4 Pillars, her assessment is truly spot on!

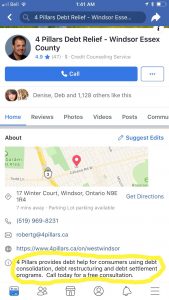

It is interesting how 4 Pillars portends in their advertising that they engage in Debt Settlement processes yet when confronted by officials they deny. Recently I reviewed a Facebook Business Page by a Windsor, Ontario, 4 Pillars franchise manager and clear as day, they are stating that they provide Debt Settlement services, yet are not registered with the Ministry and as such cannot provide these services. (Fig 1)

I find it ironic that 4 Pillars is suing Ms. Craig for defamation when the truth is abundantly clear! 4 Pillars continues to skirt the reality of the situation, as they are clearly providing debt settlement services in contravention of the Statutory Act, as indicated by their Windsor Franchise manager. When 4 Pillars states that they can do things that the trustee cannot, they are correct as the 4 Pillars agent is not governed by any entity in Canada. I will tell you that what they think they can do is represent a debtor in the negotiation of a settlement between a creditor, collection agency or a trustee when in fact, they have no legal authority or standing by any statute or regulation that gives 4 Pillars and their franchise managers the right to represent the debtor in any capacity.

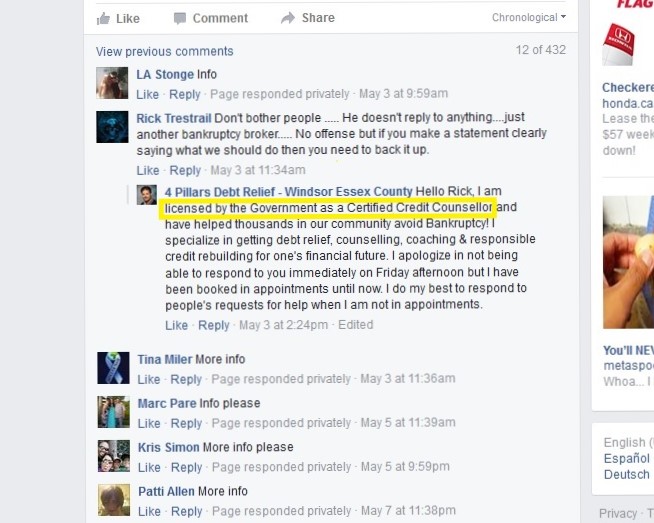

It is important for debtors to understand that Debt Consultants do not provide ANY legitimate help for a debtor and in many cases can lead a debtor down a road that is more damaging than when they started with the Consultant. Because 4 Pillars cannot provide legal advice to a debtor, I wonder how a debtor can feel comforted by their services. The debtor is about to embark on a legal journey under the Bankruptcy and Insolvency Act of Canada, yet the Consultant cannot provide any legal advice in that process. The debtor needs to know the legal implications of their decisions, yet 4 Pillars franchise managers cannot provide any legal advice regarding those decisions. One piece of advice we were told by 4 Pillars Corporate offices were to tell debtors to stop making payments to their creditors. When I confronted my 4 Pillars franchise manager on this issue in the past, he told me to just tell the debtor that we can tell the debtor what past clients have done as this will allow us to circumvent the “legal advice” issue as we are only “describing” what others have done. Again, I ask then, what value are we providing to the unsuspecting debtor? I recently came across a Facebook Ad by the Windsor Franchise manager. (Fig 2)

In the messaging part of the Ad an individual questions the 4 Pillars Manager’s authority in dealing with a debtor’s needs. The 4 Pillars manager simply states, “I am licensed by the Government as a Certified Credit Counselor.” Now I have checked with the “Government”, both at the Federal and Provincial levels and have discovered that there are no licensing requirements of a Credit Counselor. I am aware that the Ministry of Government and Consumer Services requires Credit Counselors to be registered as a “Collection Agency”, but I am at a loss as to how the 4 Pillars agent describes himself as being licensed by any Government Agency when in fact, he is not.

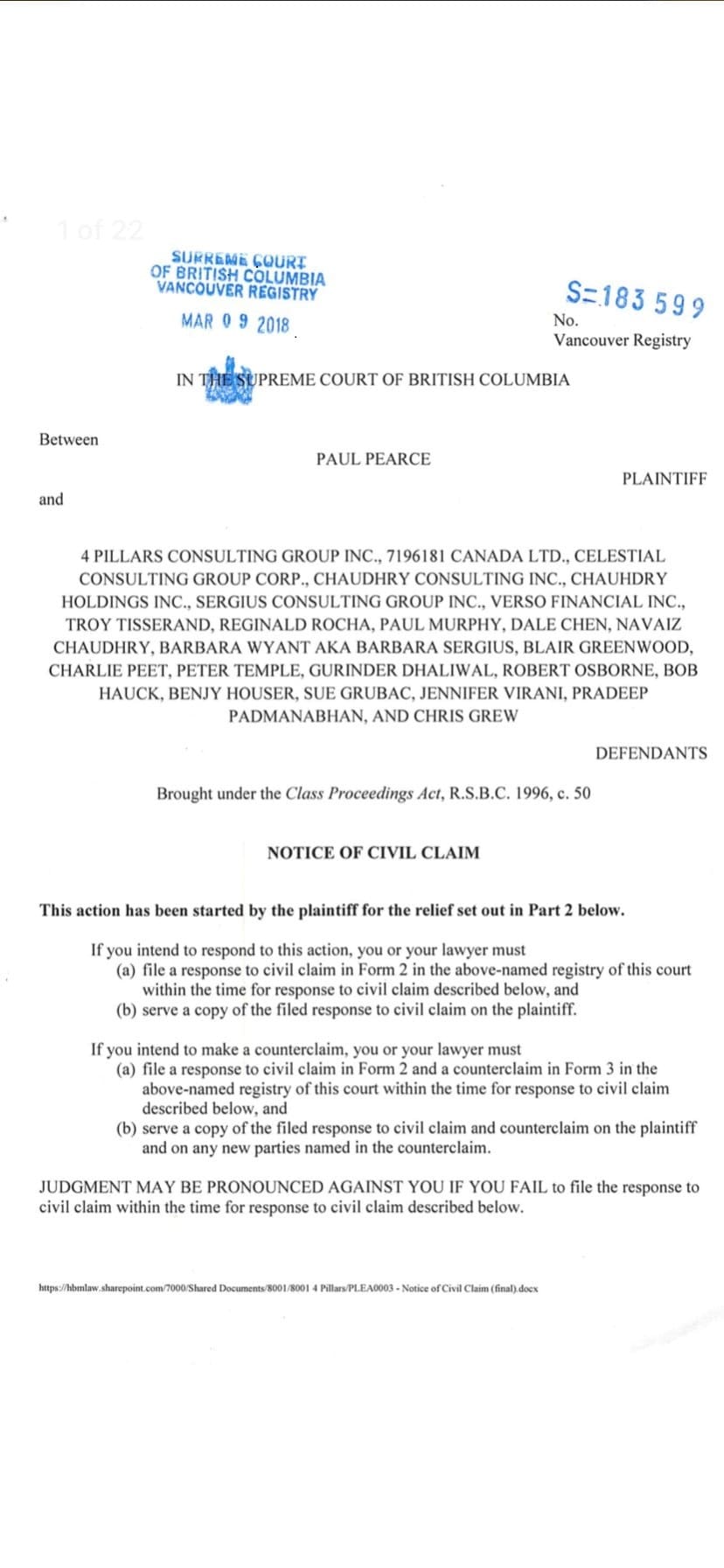

Finally, I recently learned that 4 Pillars is being sued by a class of Debtors in British Columbia. (Fig 3) Not surprising, the debtors are suing for some of the reasons as set out above. More specifically, however, the class of debtors are suing because they were charged fees in contravention of British Columbia Statute. These new laws came into effect about the same time as our laws, here in Ontario. In no uncertain terms, the two statutes between B.C. and Ontario are very similar. In B.C. a company that engages in the practice of negotiating debt(s) on behalf of a debtor cannot charge a fee before a restructured proposal has been accepted by a debtor’s creditors and the company must be registered with the Ministry. Likewise, in Ontario the Collection and Debt Settlement Services Act requires that first a company be registered under the Act unless they meet the requirements for exemption, which 4 Pillars does not. Second, aside from a nominal $50 fee, a company that engages in the practice of settling debts on behalf of another can only collect their fee once the settlement has been agreed to by the creditor and debtor. In a Consumer Proposal scenario, under the BIA this would be 45 days after the filing of the Consumer Proposal and acceptance of same by the creditors. In an individual settlement, this would be upon payment and signed agreement in a debt settlement agreement. I would argue that 4 Pillars, at the very least, from my experience with the organization as an employee, fail to meet their obligations under the Collection and Debt Settlement Services Act.

In closing, it is my contention that 4 Pillars Consulting Group will become registered with the Ministry of Government and Consumer Services here in Ontario in the coming months. With the ongoing litigation occurring in British Columbia, both with the 4 Pillars defamation case against a Licensed Insolvency Trustee and the Class of Debtors suing 4 Pillars for violations against the BIA and the Provinces Debt Settlement Services Act, it appears that similar cases will be filed here in Ontario, in the short term. Considering the negative impact these matters have had on their organization thus far it would only seem logical as their play on words in their attempts to circumvent legislation has come to pass. It is time that 4 Pillars joins the rest of the Insolvency and Debt Restructuring Industry and become licensed and registered in accordance with the various statutes and regulations that govern our great Province. 4 Pillars can provide a valuable service to the public, if only they would get on board with the changes that are aimed at protecting unsuspecting and vulnerable debtors.